- Publication year : 2024

1~18 item / All 18 items

Displayed results

Added to bookmarks

Bookmarks listBookmark has been removed

Bookmarks listYou can't add any more bookmarks

By registering as a member, you can increase the number of bookmarks you can save and organize them with labels.

Free membership registration

Contact this company

Contact Us Online1~18 item / All 18 items

An explanation of the scenery and thoughts seen by owner-managers standing at the crossroads of succession! Spica Consulting Co., Ltd. will hold a seminar titled "Why Did the Founder of Pine Valley Choose a Search Fund?" Founded in 2008, Pine Valley Co., Ltd. specializes in customizations and tuning of the American motorcycle brand "Harley-Davidson." Its base in Kōura, Kanazawa Ward, Yokohama, has established a solid brand as the "holy land for Harley riders." On the day of the seminar, we plan to present themes in a panel discussion format, such as the following (examples): 【Themes (Examples)】 ■ How did they weigh the options for business succession? ■ What are the differences compared to regular M&A? ■ What is the main reason for choosing a search fund? ■ Were there any concerns or points of anxiety? ■ Thoughts on the succession being executed in March 2024, looking back now.

Added to bookmarks

Bookmarks listBookmark has been removed

Bookmarks listYou can't add any more bookmarks

By registering as a member, you can increase the number of bookmarks you can save and organize them with labels.

Free membership registration

An explanation of the scenery and thoughts seen by owner-managers standing at the crossroads of succession! Spica Consulting Co., Ltd. will hold a seminar titled "Why Did the Founder of Pine Valley Choose a Search Fund?" Founded in 2008, Pine Valley Co., Ltd. specializes in customizations and tuning of the American motorcycle brand "Harley-Davidson." Its base in Kōura, Kanazawa Ward, Yokohama, has established a solid brand as the "holy land for Harley riders." On the day of the event, we plan to present themes in a panel discussion format, such as the following (examples): 【Themes (Examples)】 ■ How did they select and prioritize options for business succession? ■ What are the differences compared to regular M&A? ■ What is the main reason for choosing a search fund? ■ Were there any concerns or points of anxiety? ■ Reflections on the succession to be executed in March 2024, and thoughts now.

Added to bookmarks

Bookmarks listBookmark has been removed

Bookmarks listYou can't add any more bookmarks

By registering as a member, you can increase the number of bookmarks you can save and organize them with labels.

Free membership registration

Methods to effectively enhance corporate value! Successful business leaders will take the stage. Our company will hold seminars on "Value Up (Corporate Value) Management" in four cities: Tokyo (online), Osaka, Nagoya, and Fukuoka. In this seminar, successful companies practicing value-up management and experts from various industries will discuss the transformations required by society and the industry, as well as the challenges that companies want to address in the near term, contributing to the corporate value that resolves both. This seminar is recommended for those who feel uncertain about managing independently due to the rapid changes in society and the industry, or for those who want to learn about the management strategies and specific measures of continuously growing companies.

Added to bookmarks

Bookmarks listBookmark has been removed

Bookmarks listYou can't add any more bookmarks

By registering as a member, you can increase the number of bookmarks you can save and organize them with labels.

Free membership registration

Methods to effectively enhance corporate value! Successful business leaders will take the stage. Our company will hold seminars on "Value-Up (Corporate Value) Management" in four cities: Tokyo (online), Osaka, Nagoya, and Fukuoka. In this seminar, successful companies practicing value-up management and experts from various industries will discuss the transformations required by society and the industry, as well as the challenges that need to be addressed in their own companies, contributing to the corporate value that can resolve both. This seminar is recommended for those who feel uncertain about managing their company alone due to the rapid changes in society and the industry, or for those who want to learn about the management strategies and specific measures of continuously growing companies.

Added to bookmarks

Bookmarks listBookmark has been removed

Bookmarks listYou can't add any more bookmarks

By registering as a member, you can increase the number of bookmarks you can save and organize them with labels.

Free membership registration

Methods to effectively enhance corporate value! Successful business leaders will take the stage. Our company will hold seminars on "Value-Up (Corporate Value) Management" in four cities: Tokyo (online), Osaka, Nagoya, and Fukuoka. In this seminar, successful companies practicing value-up management and experts from various industries will discuss the transformations required by society and industries, as well as the challenges that need to be addressed in their own companies, contributing to the resolution of both aspects of corporate value. This seminar is recommended for those who feel uncertain about managing their company alone due to the rapid changes in society and industries, or for those who want to learn about the management strategies and specific measures of continuously growing companies.

Added to bookmarks

Bookmarks listBookmark has been removed

Bookmarks listYou can't add any more bookmarks

By registering as a member, you can increase the number of bookmarks you can save and organize them with labels.

Free membership registration

Methods to effectively enhance corporate value! Successful business leaders will take the stage. Our company will hold seminars on "Value-Up (Corporate Value) Management" in four cities: Tokyo (online), Osaka, Nagoya, and Fukuoka. In this seminar, successful companies practicing value-up management and experts from various industries will discuss the transformations required by society and industries, as well as the challenges that companies want to address in the near term, contributing to corporate value. This seminar is recommended for those who are concerned about managing their companies independently in a rapidly changing society and industry, or for those who want to learn about the management strategies and specific measures of continuously growing companies.

Added to bookmarks

Bookmarks listBookmark has been removed

Bookmarks listYou can't add any more bookmarks

By registering as a member, you can increase the number of bookmarks you can save and organize them with labels.

Free membership registration

★AMANO SCOPE Mr. Shinya Amano & Monozukuri Taro Channel, Recommended by Mr. Monozukuri Taro! "Learn from past cases and you can compete even in your first M&A!" ★ A fully industry-focused M&A consultant explains the challenges and potential of the manufacturing industry! ★ Detailed introduction of methods to enhance corporate value through real case interviews and the latest M&A strategies! ★ Simultaneous release of four titles by industry: "Logistics Industry Edition," "Manufacturing Industry Edition," "Pharmacy Industry Edition," and "Food Industry Edition"! ▼ Recommended for mid-sized and small business owners like these: - Want to know the management strategies of continuously growing companies - Want to achieve significant growth by partnering with listed companies or large corporations - Want to learn detailed M&A cases of companies in the same industry and of similar size - Want to enhance corporate value and conduct M&A under satisfactory conditions and amounts

Added to bookmarks

Bookmarks listBookmark has been removed

Bookmarks listYou can't add any more bookmarks

By registering as a member, you can increase the number of bookmarks you can save and organize them with labels.

Free membership registration

Spica Consulting is a company that provides "Value-Up Consulting" and "Industry-Specific M&A" services. We have entered the capital umbrella of GA Technologies, which has been listed on the Tokyo Stock Exchange Growth Market within a year of its founding. Why did an M&A consulting company choose to partner with a real estate tech company? First, we found that the business models are similar, and by referencing the paths taken by other industries that are ahead, we concluded that the real estate industry and M&A brokerage have closely related business models. Additionally, GA Technologies is the one driving innovation through IT in the real estate industry, which still retains many analog elements. In this way, considering potential partners that can be expected to grow further is positioned as a very important "preparation period." While our capital comes under GA Technologies, all of our management team will continue in their roles, and we have chosen to pursue further corporate growth. We hope to first clarify what resources we lack and understand that "M&A" is a means to acquire those resources.

Added to bookmarks

Bookmarks listBookmark has been removed

Bookmarks listYou can't add any more bookmarks

By registering as a member, you can increase the number of bookmarks you can save and organize them with labels.

Free membership registration

Our company has started offering a diagnostic service to measure employee satisfaction regarding M&A, aimed at supporting smooth PMI between companies that have undergone M&A, starting from June 4th. This service involves surveying employees belonging to the acquired company about their satisfaction with the work environment, interpersonal relationships, and treatment after the M&A. The survey is conducted by our company as a third-party organization, ensuring the anonymity of the employees through the aggregation and analysis of responses. The survey report, created from both quantitative and qualitative perspectives with an objective viewpoint, can not only be used to discover new management challenges but also visualizes the often-invisible strengths of the company, such as corporate culture and communication among employees. This makes it useful as proposal material for potential future acquisition targets.

Added to bookmarks

Bookmarks listBookmark has been removed

Bookmarks listYou can't add any more bookmarks

By registering as a member, you can increase the number of bookmarks you can save and organize them with labels.

Free membership registration

Our company will establish a research institution called "Value Up Lab," aimed at analyzing management factors that contribute to enhancing corporate value in five industries: manufacturing, logistics, healthcare, energy, and food, as well as disseminating information on advanced management issues specific to each industry. At the end of September, we plan to release a white paper focused on the five industries as the first publication from "Value Up Lab."

Added to bookmarks

Bookmarks listBookmark has been removed

Bookmarks listYou can't add any more bookmarks

By registering as a member, you can increase the number of bookmarks you can save and organize them with labels.

Free membership registration

[To Small and Medium-Sized Business Owners] The reasons why three companies with different areas of expertise in press processing decided to pursue M&A will be revealed in a seminar. August 26 (Monday) at 1:00 PM. Shin-ei Holdings Co., Ltd. is enhancing corporate value through M&A. In this seminar, Mr. Nakamura, the representative director, will specifically discuss the M&A strategies that Shin-ei Holdings has been working on to solve management challenges. Additionally, two individuals who have remained as managers after joining Shin-ei Holdings will share their experiences regarding the background of their M&A decision and the current situation after several years. ◆ Recommended for those who: Want to learn about the benefits and synergies seen in manufacturing M&A. Want to hear the real voices of transferring company executives. Feel limited in growth on their own. *You can view this seminar with a PC, tablet, or other devices with an internet connection. *Please note that the distribution system may not function properly due to security software or other features. Thank you for your understanding.

Added to bookmarks

Bookmarks listBookmark has been removed

Bookmarks listYou can't add any more bookmarks

By registering as a member, you can increase the number of bookmarks you can save and organize them with labels.

Free membership registration

[To Small and Medium-Sized Business Owners] The reasons why three companies with different areas of expertise in press processing decided to pursue M&A will be revealed in a seminar. August 26 (Monday) at 1:00 PM. Shin-ei Holdings Co., Ltd. is enhancing corporate value through M&A. In this seminar, Mr. Nakamura, the representative director, will specifically discuss the M&A strategies that Shin-ei Holdings has been working on to solve management challenges. Additionally, two individuals who have remained as managers after joining the Shin-ei Holdings group will share their genuine experiences regarding the background of their M&A decision and the current situation after several years. ◆Recommended for those who: Want to learn about the benefits and synergies seen in manufacturing M&A Want to hear the real voices of transferring business owners Feel limited in growth by their own company alone.

Added to bookmarks

Bookmarks listBookmark has been removed

Bookmarks listYou can't add any more bookmarks

By registering as a member, you can increase the number of bookmarks you can save and organize them with labels.

Free membership registration

In this seminar, Haruka Matsue, a director of our company with extensive experience in M&A support in the manufacturing industry, will have a special discussion with "Seirin International Patent and Trademark Office," which has numerous achievements in intellectual property strategy. In Japan, the creation of innovations that can dominate the world has stagnated, causing Japanese companies to fall behind in global competitiveness. The proportion of intangible assets in corporate value (market capitalization) is low, with the U.S. market (S&P 500) at 90% compared to the Japanese market (Nikkei 225) at 30%. In recent years, as the importance of intangible assets to corporate value has increased, the "Intellectual Property and Intangible Asset Governance Guidelines Ver. 2.0" was established in 2023, marking the beginning of an era where dialogue with stakeholders utilizing intellectual property investment strategies is increasingly required. Understanding intellectual property strategies correctly and strategically utilizing intangible assets in management directly leads to the creation of profitable businesses. On that day, we hope participants will learn from specific corporate examples that have successfully monetized intellectual property and gain insights to enhance their own corporate value. ★ June 11 (Tuesday) from 1:00 PM to 2:00 PM! Please check the details and apply from the page below.

Added to bookmarks

Bookmarks listBookmark has been removed

Bookmarks listYou can't add any more bookmarks

By registering as a member, you can increase the number of bookmarks you can save and organize them with labels.

Free membership registration

In the manufacturing industry, where industry-specific business practices are deeply rooted, there is a perception that "marketing is not suitable for manufacturing" and "generating business opportunities through web marketing is difficult." FA Products Co., Ltd., which develops factory automation (FA) equipment to automate factories, has found that acquiring new customers has become urgent due to rapid changes in the market environment. In this seminar, we will invite Mr. Shinya Amano, an advisor to the company, for a special discussion with our director, Haruka Matsuoe, who has extensive M&A experience in the manufacturing industry, about FA Products' specific marketing strategies. We will also thoroughly explain the latest trends in the industry and the reasons why Japanese manufacturing companies must focus on marketing. 【Start Date of Distribution】 October 11, 2023 (Thursday) 【How to Apply】 Please apply using the form below. We will send the URL for the video to the email address you registered. https://spicon.co.jp/lp/manufacturing231011/

Added to bookmarks

Bookmarks listBookmark has been removed

Bookmarks listYou can't add any more bookmarks

By registering as a member, you can increase the number of bookmarks you can save and organize them with labels.

Free membership registration

Our company has established a research team aimed at improving the quality of M&A brokerage services starting in March 2024. We will utilize advanced technologies such as AI to support consultants in making more sophisticated proposals. The newly established research team aims to achieve higher quality M&A support by utilizing advanced technologies such as image processing and generative AI to reduce and streamline the complex tasks of consultants.

Added to bookmarks

Bookmarks listBookmark has been removed

Bookmarks listYou can't add any more bookmarks

By registering as a member, you can increase the number of bookmarks you can save and organize them with labels.

Free membership registration

Starting January 22, 2024, our company will begin offering the "Value Up BOOK," which focuses on four industries: pharmacy, logistics, manufacturing, and energy (LP gas). This is a collection of materials for business owners that explains industry trends, basic knowledge of M&A, M&A case studies for each industry, and methods for value-up consulting (enhancing stock value). Consultants with extensive experience and a proven track record in the industry have carefully selected and created this information to contribute to corporate growth, along with explanations. We will distribute this material for free to business owners who have had individual consultations with us. If you would like the materials, please apply for an individual consultation.

Added to bookmarks

Bookmarks listBookmark has been removed

Bookmarks listYou can't add any more bookmarks

By registering as a member, you can increase the number of bookmarks you can save and organize them with labels.

Free membership registration

Our company held the "M&A CONSULTANT CAREER MEETUP #01" on April 19, 2024, aimed at individuals interested in employment or career changes in the M&A brokerage industry, as well as those looking to advance their careers in M&A consulting. The inaugural event on April 19 was limited to the first 30 participants and featured a networking session themed "The Career of an M&A Consultant: The Past, Present, and Future." The discussion focused on the environment surrounding the job of an "M&A Consultant," the transformation of its image, and the skills that will be necessary for consultants moving forward.

Added to bookmarks

Bookmarks listBookmark has been removed

Bookmarks listYou can't add any more bookmarks

By registering as a member, you can increase the number of bookmarks you can save and organize them with labels.

Free membership registration

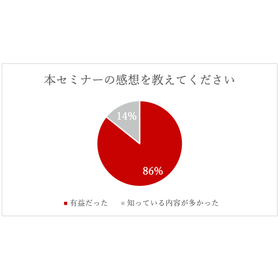

Spica Consulting Co., Ltd. held a seminar on "Developing Business Succession Strategies for Future Preparedness" for members of the Nakahara Factory Association, a general incorporated association. On the day of the event, approximately 20 executives participated, and the survey results showed that 86.6% of attendees found it "beneficial." Additionally, we received comments from participants such as, "I was able to learn the formula for corporate value," "It wasn't directly related to me, but I understood it well," and "The elements were explained clearly in a short amount of time."

Added to bookmarks

Bookmarks listBookmark has been removed

Bookmarks listYou can't add any more bookmarks

By registering as a member, you can increase the number of bookmarks you can save and organize them with labels.

Free membership registration